News Archives

Mike Vanderboegh: 4GW - How the Next Civil War will be Fought

Mike Vanderboegh of the Sipsey Street Irregulars is working on a book that our Federal Overlords won’t like very much:

” When the Founders declared independence, they prefaced that declaration with a detailed indictment of the offenses of the King and his ministers. I will not waste time or space here by comparing the present federal government’s excesses of arbitrary power with those of King George III. Go and read the Declaration and you will marvel at how today’s advocates of central power not only track quite closely but make Lord North and Company look like kindergarten bullies in comparison.”

“The important thing to understand about today’s arbitrary power is that it, like its predecessor, is a corruption of – indeed, a subversion of – a constitution that should have restrained it. It was the failure of the English Constitution which led to our first Revolution. It will be the failure of our own Constitution which will lead to our next civil war.”

– Mike Vanderboegh

Read the entire article HERE – Read. It. All.

Zero Hedge: Weaponized America

From Tyler Durden at Zero Hedge:

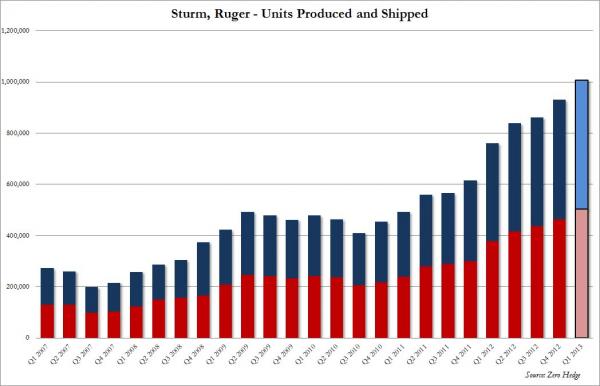

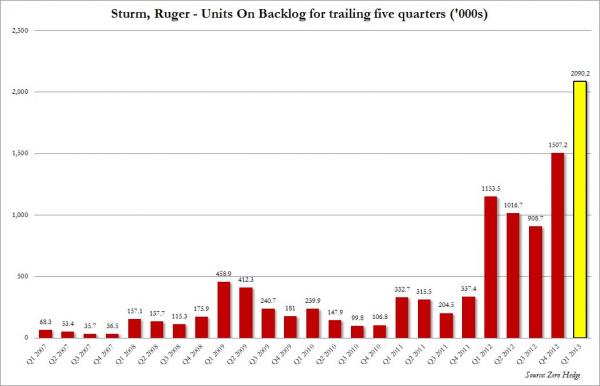

“Whether it is due to the recent governmental attempt to enforce assorted gun controlling measures in the aftermath of the Newtown, CT shooting, or, merely driven by the same catalyst that saw a surge in gun sales four years ago, namely the presidential election, one thing is certain: America is weaponizing itself at an unheard of pace, with both Sturm, Ruger shipments and units produced surpassing 500,000 each in one quarter for the first time in history.”

– Tyler Durden

Pretty impressive sales… but here is the killing joke:

“If we didn’t know better, we would say that either RGR has somehow become a $0.99 app for the latest and greatest cool, faddy cell phone, whatever that may be, or, alternatively, America is preparing for war.”

– Tyler Durden

Read the entire thing HERE.

This will all come to a head eventually. Many people are going to die when it does.

Chief Advisor To US Treasury Becomes JPMorgan's Second Most Important Man

Per Hedge HERE

With Tim Geithner having proven repeatedly and beyond a reasonable doubt he has insurmountable intellectual challenges, many have wondered just who it is that makes the real decisions at the US Treasury? The answer is, The Treasury Borrowing Advisory Committee, or the TBAC in short, chaired by JP Morgan and Goldman Sachs, which meets every quarter, and in which the richest people in America set the fate of the US for the next 3 months….

As reported yesterday, here it is officially:

- JPMORGAN SAYS INA DREW TO RETIRE; MATT ZAMES NAMED NEW CIO

- JPMORGAN SAYS DANIEL TO STAY CEO OF EUROPE/MIDEAST/AFRICA

- JPMORGAN SAYS CAVANAGH TO LEAD TEAM OVERSEEING RESPONSE TO LOSS

- JPMORGAN CHASE SAYS ZAMES NAMED NEW CIO

Now… Matt Zames… Matt Zames… where have we heard that name before… OH YES: he just happens to be the Chairman of the Treasury Borrowing Advisory Committee, aka the TBAC, aka the Superommittee that Really Runs America. The Matt Zames who… “previously worked at hedge fund Long-Term Capital Management LP, may have benefited as the collapse of Lehman Brothers Holdings Inc. and JPMorgan’s takeover of Bear Stearns Cos. left companies and hedge funds with fewer trading partners in the private derivatives markets.”

A senior executive in the inner circle of JPMorgan Chase’s chief executive, Jamie Dimon, is leaving the nation’s largest bank, the latest chapter in management turnover after the bank’s multibillion-dollar trading loss.

The executive, Frank Bisignano, the co-chief operating officer, is expected to leave as early as this week, according to several people with knowledge of his decision. The trading losses at the bank have swelled to more than $6.2 billion since first disclosed almost a year ago.

With Mr. Bisignano’s departure, executives who once surrounded Mr. Dimon as he helped steer the bank through the 2008 financial crisis will be even thinner. Several other executives have already left, including Heidi Miller, James E. Staley, Bill Winters and Steve Black.

Mr. Bisignano will become chief executive of First Data Corporation, a payment processing firm, people with knowledge of the matter said. Matt Zames, who had shared the role of chief operating officer with Mr. Bisignano, is expected to take over all aspects of the job, according to people with knowledge of the decision, which they said, should make a smooth transition.

To summarize: the man who is the chief advisor to the US Treasury on its debt funding and issuance strategy was just promoted to the rank of second most important person at the biggest commercial bank in the US by assets (of which it was $2.5 trillion), and second biggest commercial bank in the world. And soon, Jamie willing, Matt is set for his final promotion, whereby he will run two very different enterprises: JPMorgan Chase and, indirectly, United States, Inc.

And that, ladies and gentlemen, is how you take over the world.

Hang Them... Every Last Goddamned One of Them

Dan Riehl at Riehl World News Brings us this Politico Story:

“Congressional leaders in both parties are engaged in high-level, confidential talks about exempting lawmakers and Capitol Hill aides from the insurance exchanges they are mandated to join as part of President Barack Obama’s health care overhaul, sources in both parties said.”

“The talks — which involve Senate Majority Leader Harry Reid (D-Nev.), House Speaker John Boehner (R-Ohio), the Obama administration and other top lawmakers — are extraordinarily sensitive, with both sides acutely aware of the potential for political fallout from giving carve-outs from the hugely controversial law to 535 lawmakers and thousands of their aides. Discussions have stretched out for months, sources said.”

– Politico

Red the entire intolerable outrage HERE.

Update I: It’s Good to be King

Thanks to Tyler Durden at Zero Hedge for this little “add-on:

“The chief of the FAA told Congress today that Washington-area airports will largely escape the effects of the air traffic controller furloughs — a blessing for lawmakers who fly out of the nation’s capitol.”

“Michael Huerta, head of the Federal Aviation Administration, told a congressional panel that the Washington region’s airports are spaced out enough and have enough spare capacity that furloughs to air traffic controllers won’t hurt as much here.”

– The Washington Times

Read the rest HERE.

They fancy themselves your masters.

“They going to exempt themselves from gravity next?”

– Zero Hedge Poster

Update II: Bill Quick: Laws Are For the Subjects, Not Their Betters

The erstwhile Bill Quick of Daily Pundit reminds us:

“Still, if they do this, they will make it perfectly clear how the Ruling Class regards itself in relation to those it purports to rule. The law is for little people. Rulers should never be inconvenienced by the law at all. Otherwise, what is the point of being a ruler?”

– Bill Quick

Click HERE for more information.

Update III: The Emperor Howls

Emperor Misha at the Anti-Idiotarian Rottweiler points out an article we missed:

“So, both Democrats and Republicans clearly realize that Obamacare, if implemented in Congress, will kill jobs and raise health insurance costs. Is their solution to repeal Obamacare and save the rest of the country that same burden? No. Of course not. Their solution is to see how they can exempt themselves from the law. The rest of us, who have to live with it? Tough cookies, proles. Health care costs money. Deal with it.”

“I guess my only question is, why are we not not dragging members of Congress—of both parties—naked and screaming from their offices for a good tar and feathering?”

– Dale Franks

Read the entire thread HERE.

Baldur's Custom Gate Portraits Section

The Baldur’s Gate Custom Portraits Section has been completed, with scores of unique and theme based character icons to download. Click HERE for more details.

Diablo II Equipment Guide Finished

The Diablo Equipment Section is up, with lists of the pre-patch equipment in Diablo II and the base equipment in Diablo I, information that is hard to track down these days. Click HERE for more information.

Chinese woman sues Fed for money Devaluation

I figure a little bit of comedy here at Deth from time to time couldn’t hurt.

A woman in Kunming, Yunnan province, is trying to sue the United States central bank after discovering that the real value of the US$250 she put in an account in 2006 had shrunk by 30 per cent.

She claims it was a result of the Federal Reserve issuing too much money.

Her attorney, her son Li Zhen , called the lawsuit “litigation for the public good” which aimed to stop the Fed from continuing its quantitative easing policy and promote people’s awareness of their rights.

He filed the lawsuit alleging “the abuse of monopoly in issuing currency” last month at the Kunming Intermediate People’s Court on behalf of his mother, Liu Hua , but the court has yet to decide whether to officially place the case on file.

Since the global financial crisis, the Fed has been pumping more money into the economy via several rounds of so-called quantitative easing to try to boost consumer spending and revive economic growth.

The judges were “greatly surprised” to see the indictment, said the 36-year-old lawyer, adding he was the first mainlander to have filed a lawsuit against a foreign country’s central bank.

Li, who works at the Yunnan Tongbang Law Firm, said he referred to Black’s Law Dictionary, the most cited legal dictionary in the US, and concluded that the Fed is a private institution instead of a government department.

According to the dictionary, US financial institutions are required to invest in the Federal Reserve System if they want to join it, which he construed as meaning the Fed is privately owned.

“Since the Fed is a private institution which enjoys a monopoly over the issuing of currency, US dollar holders can sue it for printing too much money,” he said.

Li said he requested two things from the court – that the Fed halts the abuse of its monopoly over the issuing of dollars and that it makes a “symbolic compensation” of US$1. Asked about the possibility of whether the court will accept the case, Li said it was “difficult to say”.

He added: “Since the Anti-Monopoly Law was enforced in 2008, there have been not many serious lawsuits in this regard.

“It was not until early last year that a judicial interpretation for civil anti-monopoly cases was issued … besides, this case involves very professional issues and is very complex.”

He said he was looking for more “victims” like his mother and expected to bring a class action in a US court.

Professor Wang Xiaoye , an expert on anti-monopoly law, said the depreciation of a currency was a business risk that holders had to bear.

Article can be viewed HERE

"We're All Smugglers Now" - Mike Vanderboegh

Mike Vanderboegh at the Sipsey Street Irregulars is a smuggler now – and he dares them to do something about it:

Transcript:

My name is Mike Vanderboegh and I’m a smuggler. I am from the great free state of Alabama and I am a Three Percenter.

If you need to pigeonhole my politics I consider myself a Christian libertarian. I believe in free men, free markets, the rule of law under the Founder’s Republic and that the Constitution extends to everyone regardless of race, creed, color or religion.

I most especially believe in the right of the people to keep and bear arms as the ultimate guarantor of liberty.

I have also been called a “seditionist” by members of the current regime. If faithfully fulfilling my oath to the Founders’ Republic and unrelenting hostility to those who would undermine and overthrow it makes me a “seditionist” then I cheerfully plead guilty.

The Three Percent movement I founded has been denounced by that paragon of moral virtue Bill Clinton and I am a perennial “honorable mention” on the Southern Poverty Law Center’s list of dangerous folks. I have even been the subject of an eighteen and a half minute rant by Rachel Madcow on MSNBC and the current Attorney General of the United States knows — and despises — me by name because of the Fast and Furious scandal that, with my friend David Codrea, I broke the news of on the Internet. Eric Holder would not be surprised to know that the feeling is mutual.

The Coalition to Stop Gun Violence calls me an “insurrectionist” because I don’t believe, as they do, in a government monopoly of violence, but rather in a literal interpretation of the 2nd Amendment as a bulwark against tyranny. Well, as my friend Kurt Hofmann says, “It is better to be despised by the despicable than admired by the admirable” and I suppose my remarks here today will only reinforce my enemies’ opinions of me. I think I can bear the burden.

Yesterday was the anniversary of the battles of Lexington and Concord in 1775, but also of the liquidation of the Warsaw ghetto in 1943 and that of the Branch Davidians at Waco fifty years later to the day — two examples of what happens when governments exercise a monopoly of violence.

It is proper, then, to contemplate the lessons of the date in history — April 19th — then, now and in the near future. What I say now I say with reluctance, sadness and not a little bit of dread, but say it I must.

FOR SILENCE IN THE FACE OF TYRANNY IMPLIES CONSENT — AND I DO NOT CONSENT!

Neither do I believe that you consent, for you would not be here today if you did. But what I say is not easy to say nor easy to hear and many of you will not like it.

“An unconstitutional law is void.” So says the standard legal text American Jurisprudence. That is certainly true. The tricky part is how we are to make that point when the local, state and federal executive and legislative branches as well as the courts are in the hands of the domestic enemies of the Constitution. Every one who is currently trying to take away your right to arms starts out by saying “I support the 2nd Amendment.” Let me tell you a home truth from Alabama — Barack Obama supports the 2nd Amendment about as much as Adolf Hitler appreciated Jewish culture, or Joe Stalin believed in individual liberty. Believe what politicians do, not what they say.

So what shall we do about this current spate of tyranny breaking out all over?

The facsimile of a semi-automatic pistol that some of you hold in your hands was smuggled into your state from the South. Manufactured in Georgia, trans-shipped to Alabama, it came across your state line in the trunk of a car. The fact that the authorities of your state have not yet banned “sponge guns” is immaterial. It could as easily been a whole trunk full of real pistols. Indeed, before this year no one thought that other firearms and related items would ever be banned — but they have been. No one thought that the authorities of your state would pass laws making criminals out of the previously law-abiding — but they did. If they catch you violating their unconstitutional laws, they will — when they please — send armed men to work their will upon you. And people — innocent of any crime save the one these tyrants created — will die resisting them.

Yet despite the cost, these unconstitutional laws MUST be resisted. For if not now, when? And if not us, who? This is no longer a “slippery slope” leading to firearm registration and eventual confiscation — it is a precipice that some states have already plunged over and that the federal government threatens to follow. Arrests are happening NOW. When, if not now, shall we resist? Will we allow ourselves to be shoved back once again, from the free exercise of our God-given, natural and inalienable rights to liberty? — Shoved back once more, muttering but compliant?

THAT IS HOW WE GOT TO THIS PLACE — WE NEVER SHOVED BACK WHEN WE COULD DO SO WITHOUT VIOLENCE. Where does it stop? When we are all disarmed slaves?

The Founders knew how to answer such tyranny. When Captain John Parker — one of the three percent of American colonists who actively took the field against the King during the Revolution — mustered his Minutemen on Lexington Green, it was in a demonstration of ARMED civil disobedience. He might have retreated at the British approach, but he didn’t. He might have ordered his men to lay down their arms, but he didn’t. His defiance was silent but plainly stated. A veteran of the French and Indian War, he did not want a war. He knew intimately the horrors of war. BUT HE ALSO KNEW THAT SOME THINGS ARE WORSE THAN WAR. The British could not tolerate his silent defiance — and someone fired a shot.

But even before the shot heard ’round the world, the colonists understood their weaknesses and their military needs and did something about it. They smuggled. They smuggled Dutch gunpowder and French flints. They smuggled tents and uniform cloth and artillery and ammunition. Boston was the high headquarters of anti-British smuggling and John Hancock was its prime minister. Connecticut was a small empire built on patriotic smuggling. The colonists knew what to do and they did it, regardless of the risk — regardless of all the King’s ministers and the King’s soldiery.

They defied the King. They resisted his edicts. They evaded his laws and they smuggled. Lord above, did they smuggle.

Now we find ourselves in a similar situation. The new King Barack and his minions have determined to disarm us. We must determine to resist them.

No one wants a new civil war (except, apparently, the anti-constitional tyrants who passed these laws and the media toadies who cheer them on) but one is staring us in the face. Yes, a civil war is staring us in the face. To think otherwise is to whistle past the graveyard of our own history. We must, if we wish to avoid armed conflict, get this message across to the collectivists who have declared their appetites for our liberty, our property and our lives —

WHEN DEMOCRACY TURNS TO TYRANNY, THE ARMED CITIZEN STILL GETS TO VOTE.

Just like King George, such people will not care, nor modify their behavior, by what you say, no matter how loudly or in what numbers you say it. They will only pay attention to what you DO.

So defy them. Resist their laws. Evade them. Smuggle in what they command you not to have. Only by our ACTS will they be impressed. Then, if they mean to have a civil war, they will at least have been informed of the unintended consequences of their tyrannical actions. Again I say —

Defy. Resist. Evade. Smuggle. If you wish to stay free and to pass down that freedom to your children’s children you can do no less than to become the lawbreakers that they have unconstitutionally made of you. Accept that fact. Embrace it. And resolve to be the very best, most successful lawbreakers you can be.

One last thing before I go. On Thursday I smuggled a half-dozen 30 round AR-15 standard capacity magazines into Connecticut in deliberate disobedience of the new state diktat.

So to Martin Looney, Mike Williams, Larry Cafarro and John McKinney I’d like to say this:

I JUST COMMITTED A “D” CLASS FELONY, YOU TYRANNICAL MORONS — PROVE IT — WHICH YOU CAN’T — AND CATCH ME IF YOU CAN.

And I’ll tell you something else. When the new ammo restrictions go into effect the first week of July, I’ll be back — with two full crates of 7.62×39 ball ammunition and I will transfer said ammunition into the hands of a Connecticut citizen without the state’s permission or paperwork.

And after I break their unconstitutional laws again, I’ll be sitting in Frank Pepe’s Pizza down in New Haven waiting for Looney and Company to come arrest me —

ANY TIME THEY THINK THEY CAN MAKE IT STICK AND FEEL FROGGY ENOUGH TO TRY.

Thank you.

– Mike Vanderboegh

See the original HERE.

Want to know what Colonial America sounded like in 1774? See the above transcript and video.

Warcraft III Updates: New Map!

For the first time in years, we have added a new Warcraft III map! Island to Island Combat features multiple challenge points, unique heroes, and numerous hidden rewards and secrets! Structured for FFA and intense 5:5 action, the map is waiting for you on the Custom Maps Page HERE.

Bob Owen's: Tread Lightly Tyrants

Bob Owens at his blog has some comments for Stretch Pelosi and her masters, who are threatening all manner of new gun regulations in the wake of their Furor’s defeat a few days prior:

Listen up, gun-grabbers.

The Second Amendment of the Constitution merely codifies the preexisting right of rebellion that was the underlying justification for the Declaration of Independence. No Congress, Senate, or President, now or in the future, may infringe upon our rights.

Ever.

A government that infringes upon those rights, and attempts to deny citizens those arms of contemporary military utility useful for the militia, invalidates its constitutional legitimacy and creates the conditions justifying an armed rebellion against that government.

At this particular moment in history, there are an estimated 110 million gun owners, owning 300+ million firearms, and a bare minimum of 15 billion rounds of ammunition.

All law enforcement agencies in the United States, along with all military forces, total less than 4 million souls, a small fraction of which that have jobs that involve proficiency with firearms.

I would strongly advise Harry Reid, Nancy Pelosi, Joe Biden, and Barack Obama to very carefully and soberly consider the ramifications of any despotic orders they would give, or unconstitutional laws they may try to pass.

The rights of citizens are sovereign.

Tread carefully.

– Bob Owens

Read the entire article and comments HERE.

We can’t really put it much more succinctly. Any new gun regulations on a national level will be viewed by the American patriots as a declaration of civil war by the federal government – God help us all of they push that far.

If these intolerable nanny-statist shits would back off and leave everybody the fuck alone, this nation wold be in a hell of a lot less danger. But… they just can’t help themselves. They lack the self discipline leave well-enough alone, and by Christ they are going to have their Stalinist Utopia even if they have to build it from a mountain of human corpses.

Their kind always eventually gets around to the death camps. But as we said… they can’t help themselves. They are killers. Murder and slaughter is part of their nature.

Physical Demand Increasing, People are BTFD

Hard to believe that with all the soundbites that commodities are done, I found it odd that American silver Eagles were going for not $2, not $4, but $6 dollars over spot for physical when looking to make another purchase for myself. This essentially is a wash back to $28 resistance level when looking at the price of silver including spot. The paper market has slowly but surely split from physical and this is simply more proof of it. Found some interesting tidbits on physical demand recently….

Gold sales from Perth Mint, which refines nearly all of the nation’s bullion, have surged after prices plunged, adding to signs that the metal’s slump to a two-year low is spurring increased demand.

“The volume of business that we’re putting through is way in excess of double what we did last week,” Treasurer Nigel Moffatt said, without giving precise figures. “There’s been people running through the gate.”

“There’s been significant sales made as people see this as great value,” Mr Moffatt said. “Gold owners are very reactive to significant market movements.”

The Perth Mint’s sales of gold coins climbed 49 per cent to 97,541 ounces in the three months ended March 31 from a year earlier

Beijing gold store two hours to sell 20,000 grams of gold bullion trading volume of nearly 200 million

People have to rush to buy gold, … gold bullion out of stock yesterday, investors yesterday to spend as much as 600 million yuan to buy 20 kilograms of gold bars

The mad pursuit gold insufficiency is not just a game for the rich. Yesterday, the Yangcheng Evening News reporter learned from the East flowers to Bay store, many growers, pork traffickers, fishmonger recently put down his job went straight to the mall to buy gold.

Some Japanese also harbor fears that the expansionary monetary and fiscal policies dubbed “Abenomics”, coupled with a national debt more than twice as large as annual economic output, could trigger a crisis down the line.

Skeptics about the radical attempt to reflate the economy — or those simply worried that a slide in the yen that began in anticipation of Abe’s election victory last December will continue unabated — are still buying gold, dealers say.

“Investors in gold are convinced that Japan’s fiscal position will get worse,” said Wakako Harada, general manager of Japan’s top bullion house, Tanaka Kikinzoku Kogyo.

“What I see at our counter is that more people are getting worried about Japan. That’s why we are seeing a lot of buying.”

“In contrast this time, we are seeing interest to buy on dips to take exposures to gold,”

“Investors are using this opportunity to buy gold to diversify beyond bonds, stocks and the yen currency as Japan’s fiscal situation could deteriorate.

Japanese individual investors doubled gold purchases yesterday at Tokuriki Honten, the country’s second-largest retailer of the precious metal.

“Gold buyers in India, the world’s biggest consumer, are flocking to stores to buy jewelry and coins, betting a selloff that plunged bullion to a two-year low may be overdone.” Wait, so instead of jumping out off high buildings, Indians are being cool, calm and collected and… buying more? Unpossible. Do they not get CNBC in Mumbai? Apparently not: “My daughter is just six months old, but I think it is never too early to buy gold,” said Sharmila Shirodkar, a 28- year-old housewife, while displaying a new pair of earrings she bought from a store in Mumbai’s Zaveri Bazaar. “I had been asking my husband every day if prices will go down more. I couldn’t wait anymore.”

While the drop in gold prompted investors worldwide to pare holdings in exchange-traded products, surging physical demand in India may help stem the 17 percent slide in prices this year. The plunge after rallying for 12 straight years may make bullion more affordable to Indians, according to Mehul Choksi, chief executive officer of Gitanjali Gems Ltd. (GITG), the nation’s biggest retailer of jewelry and diamonds by sales.

“This is a perfect time to buy as prices will only go up from here,” said Vishal Mehta, a 33-year-old garment dealer, while ordering coins from Choksi V. Naginchand & Co. in Zaveri Bazaar. “I usually buy one gold coin a month, but this time I am buying two.”

Bank of America:

With prices now below $1,500/oz, we expect a pick-up in jewellery demand in the medium term and see considerable pain for miners should prices dip below $1,200/oz. As such, we believe the downside to gold prices may be limited to an additional $150/oz. In fact, we estimate that jewellery demand may become so pronounced by 2016 that prices could trade above $1,500/oz even if investors remain net sellers. Looking at sensitivities from a different angle, investors would need to buy merely 600t of gold to sustain prices at $2,000/oz by 2016, compared to non-commercial purchases of 1,798t in 2012.

a record 63,500 ounces, or a whopping 2 tons, of gold were reported sold on April 17th alone, bringing the total sales for the month to a whopping 147,000 ounces or more than the previous two months combined with just half of the month gone.

There is no doubt the price can go down further but this run will hit a resistance level somewhere near the cost of mining it out of the ground.A back plunge can be healthy from time to time. Lets see if this drop makes this asset class healthier.

Paper Price Down, Physical Still in Demand

Hard to believe that with all the soundbites that commodities are done, I found it odd that American silver Eagles were going for not $2, not $4, but $6 dollars over spot for physical. This essentially is a wash back to 28 resistance level when looking at the price of silver including spot. The paper market has slowly but surely split from physical and this is simply more proof of it. Found some interesting tidbits on physical demand…

Australia:Gold sales from Perth Mint, which refines nearly all of the nation’s bullion, have surged after prices plunged, adding to signs that the metal’s slump to a two-year low is spurring increased demand.

“The volume of business that we’re putting through is way in excess of double what we did last week,” Treasurer Nigel Moffatt said, without giving precise figures. “There’s been people running through the gate.”

“There’s been significant sales made as people see this as great value,” Mr Moffatt said. “Gold owners are very reactive to significant market movements.”

The Perth Mint’s sales of gold coins climbed 49 per cent to 97,541 ounces in the three months ended March 31 from a year earlier

Beijing gold store two hours to sell 20,000 grams of gold bullion trading volume of nearly 200 million

People have to rush to buy gold, … gold bullion out of stock yesterday, investors yesterday to spend as much as 600 million yuan to buy 20 kilograms of gold bars

The mad pursuit gold insufficiency is not just a game for the rich. Yesterday, the Yangcheng Evening News reporter learned from the East flowers to Bay store, many growers, pork traffickers, fishmonger recently put down his job went straight to the mall to buy gold.

"Out Of Control" Chinese Debt

Oh, how tasty. Nothing like peeking into China’s abyss for a while to take ones mind off of U.S. city bankruptcies. Lets see how China’s positioned in all of this. FT Reports HERE

A senior Chinese auditor has warned that local government debt is “out of control” and could spark a bigger financial crisis than the US housing market crash.

Zhang Ke said his accounting firm, ShineWing, had all but stopped signing off on bond sales by local governments as a result of his concerns.

“We audited some local government bond issues and found them very dangerous, so we pulled out,” said Mr Zhang, who is also vice-chairman of China’s accounting association. “Most don’t have strong debt servicing abilities. Things could become very serious.”

“It is already out of control,” Mr Zhang said. “A crisis is possible. But since the debt is being rolled over and is long-term, the timing of its explosion is uncertain.”

Local governments are prohibited from directly raising debt, so they have used special purpose vehicles to circumvent these rules, issuing bonds under the vehicles’ names to fund infrastructure projects.

Investment companies owned by local governments sold Rmb283bn of bonds in the first quarter of 2013, more than double the total for the same period last year. Such an increase would normally be expected to boost the economy, but China’s growth unexpectedly slowed to 7.7 per cent in the first quarter of 2013.

“The only thing you can do is issue new debt to repay the old,” he said. “But there will be some day down the line when this can’t go on.”

Mr Zhang added that he grew alarmed when smaller towns and counties discovered that investment vehicle bonds were an easy way to raise financing. “This evolution was quite frightening,” he said. “China has more than 2,800 counties. If every county issued debt, it could lead to a crisis. It could be even bigger than the US housing crisis.”

But Mr Zhang puts little faith in official guarantees, …: “When the time comes, it won’t be the government that assumes responsibility. It will be the accounting firms and the banks that do.”

Philadelphia, 5th Largest City in US is Effectively Bankrupt

Another city on the verge. At least the local governments have a way to discharge debt. Public interest of course has to be routed through Wall Street. Mish Reports HERE

You know a city is in deep trouble when its mayor invites Wall Street but not the press and not private citizens to a closed meeting to discuss the future, including a sell-off of city assets.

Philadelphia Mayor Michael Nutter, whose municipality has the lowest credit rating of the five most-populous U.S. cities, did just that.

My translation: Philadelphia is bankrupt. However, that easily discernible fact will of course be denied until it officially happens.

Philadelphia Mayor Michael Nutter, whose municipality has the lowest credit rating of the five most-populous U.S. cities, will address investors at a conference financed by underwriters and closed to the public and the press.

The invitation bills tomorrow’s meeting as a chance to hear “Philadelphia leaders and investors discuss building the city’s future.”

Philadelphia is hoping to attract investors for the city, which is rated three steps above junk by Standard & Poor’s. The city and its authorities have $8.75 billion in outstanding debt as of September, according to bond documents. Philadelphia’s pension system is 47.6 percent funded this year, the documents say.

Tours of city assets are set for the second day of the conference, including the Philadelphia Gas Works, the largest municipally owned natural-gas utility in the U.S. The city plans to hire a broker to steer the sale of the system, which may fetch as much as $496 million, according to Lazard Ltd. (LAZ)

Sam Katz, chairman of the Pennsylvania Intergovernmental Cooperation Authority, created in a 1991 state law that oversees the city’s finances, said that with the conference being held locally, it “certainly created some concern on the part of people that it should be made public.”

He’s more troubled, however, by the fact the school district isn’t on the agenda, he said. Facing a $304 million deficit, school officials have asked the city for $60 million and the state for $120 million.

“The school district’s in a crisis,” Katz said. “They’re the same tax base.”

Philadelphia officials facing a $1.35 billion spending gap over five years voted in March to shut 9 percent of its public schools.

It does not take a genius to figure out what is going on here. Philadelphia is bankrupt. Without even seeing the details, it is safe to assume untenable union wages and pension benefits are at the heart of it all. A 47.6% funded pension is rather telling in and of itself.

Gutless Mayor Michael Nutter does not even have the decency to let the public or the press hear what is going on. Instead he invited Wall Street to a private tour of Philadelphia’s assets, hoping to sell assets and stave off the inevitable.

Warcraft III Custom Heroes Page Updated

The Aerial Mastery Units have been added for each alignment. Alexstrasza, Nozdormu, Ysera, Malygos, and Deathwing’s stats, skills, and powers are now listed on the information pages. For more details, click HERE.

Misha: Welcome to the Last Days - Update 4/17/13

Emperor Misha at the Anti-Idiotarian Rottweiler reminds people what happens when you compromise with evil:

OK, so they’re busy destroying, systematically, the most successful, free and prosperous nation that this planet ever knew, a nation that did quite well indeed for two centuries until they started gaining traction, but don’t let’s be beastly about it. Can’t we all just agree to disagree in a civil fashion while the planet’s last, fading hope of liberty and prosperity gets snuffed out?

No. We can’t.

Call us old fashioned, but concepts like liberty aren’t negotiable to us. Perhaps they’re even less negotiable to His Imperial Majesty because we, unlike the pampered, helpless, worthless, pussified punks of this nation actually know what it’s like to be chained even if the chains were wonderfully covered with velvet and rather like the feeling of not wearing them anymore. And we take great offense at anybody, anywhere, no matter what their intentions or rationale, trying to put us back into them. Great, violent offense.

So let’s, by all means, be beastly to the socialists. Let’s be as beastly as we possibly can. Let us put our heads together and come up with new and innovative ways in which to be beastly to them in ways that will not only hurt them, but terrify them.

Let us quit pretending that socialism is something with which one can get along, because it isn’t. It is anathema to anything an individual who values his or her personal liberty believes. The two cannot coexist.

Ever.

You cannot compromise a little bit with socialism without giving up the whole deal, any more than you can be “a little bit pregnant.” There are no “grades of liberty.” Either you have it, or you don’t. Period. End. Stop.

Emperor Misha I

Read the entire post HERE.

War’s coming. We don’t like it, but the two ideologies competing in this nation cannot peacefully co-exist much longer. The Prog-Nazis will never surrender, and they cannot abide people who think differently than them – it’s only a matter of time before they start purging or reach too far up Lady Liberty’s skirt and get purged themselves.

“That sounds extreme!” you say casual reader?

We agree – it does sound extreme. It’s also historically supported by what happened every time the Authoritarian Left seized total power in the last 150 years. They are so intolerant, and so demanding of subservience to their cause, they simply can’t help themselves – as sure as water will wet, and fire will burn, the bastards will get around to setting up death-camps eventually.

It’s their nature.

Update 4/17/13: Shit Spins the Fuck Off the Rails

The Emperor has more to say on the subject of Civil War HERE:

If what is happening leads to what increasingly looks inevitable, then that is not a reason for good cheer and “America FUCK YEAH!”, because all of us, no exceptions, will have a lot to answer for. Both to ourselves in the unlikely event that we survive and to G-d when we face Him.

I’m not trying to be a downer here, because we have to do what we have to do and slavery is not an option, it is worse than any alternative, but keep all of this in mind.

Grim resolve and determination is the order of the day if, Heaven forbid, it comes to that, we’ll do what we have to do as free human beings, but don’t delude yourselves into thinking that it will, in any way, be glorious.

Because it won’t be.

I can promise you that much.

– Emperor Misha I

Read his entire post HERE.

He’s correct, things will get as black as night before this shit-storm finishes it’s downpour.Nobodies hands will be clean, and the world as we know it will be changed – and probably for the worse. War is some bad shit. But we’d note, probably not as bad as watching our kids suffer as serfs.Looks like choice A is a big pile o’ shit, and choice B is a bigger, smellier pile of shit. Thrilling selection that.

Speaking of Excrement hitting the rotating oscillator we have THIS from Bob Owens:

California energy officials urged people in the South Bay to cut back on power use Tuesday after a PG&E substation was damaged by vandals overnight.

The California Independent System Operator issued a Flex Alert for Tuesday, asking Santa Clara County and Silicon Valley utility customers to cut down their electricity use until midnight, including by lowering lighting, turning off thermostats and powering down unnecessary appliances.

Vandals appeared to have shot up a bank of transformers at a PG&E transmission center just southeast of San Jose, a PG&E spokesman said. Crews were working to clean up an oil spill caused by bullet holes.

Oh son-of-a-bitch… it’s looking like a warning shot was just fired across the bow of the “Good Ship” U.S.S. Tyranny… and then a second volley…

The Santa Clara County Sheriff’s Department said there was a breach of the security fence at approximately 3:25 a.m., and five transformers at the substation were vandalized by the gunfire.

Meanwhile, AT&T has now also blamed a large telephone outage in southern Santa Clara County Tuesday morning on vandalism.

Cell phones and landlines were said to be impacted by apparent damage to a fiber optic line. That line, which runs relatively close to PG&E’s substation, was believed to have been cut.

Surely that’s enough of a warni… oh fuck….

An envelope thought to contain ricin was sent to the Capitol Hill office of Sen. Roger Wicker.

The letter to the Mississippi Republican was intercepted at an off-site mail screening facility and never reached the Hill.

Those of you understanding the games being played with our second amendment rights know full well who Senator Wicker is, and what he’s been up to…

So we ask constant readers… did we just see the second America Revolution start?

Folks… we’re begging ya… get that pantry stocked up. Thanks.

German "Wise" Men Push for Eurozone Wealth Seizure

Looks like Cyprus as gone from an example to a leaping platform. No longer do they even feel bound to hide the message.

Two top advisers to German Chancellor Angela Merkel have called for a tax on private wealth and property in eurozone debtor states to force the rich to fund rescue costs, marking a radical new departure for EMU crisis strategy.

Professors Lars Feld and Peter Bofinger said states in trouble must pay more for their own salvation, arguing that there is enough wealth in homes and private assets across the Mediterranean to cover bail-out costs. “The rich must give up part of their wealth over the next ten years,” said Prof Bofinger.

The two economist are members of Germany’s Council of Economic Experts or “Five Wise Men”, a body that advises the Chancellor on major issues. There is no formal plan to launch a wealth tax but the council is often used to fly kites for new policies.

Prof Bofinger told Spiegel Magazine that it was a mistake to target deposit holders in banks, the formula used in the EU-IMF Troika bail-out for Cyprus where those with savings above €100,000 at Laiki and Bank of Cyprus face huge losses. “The canny rich in southern Europe just shift their money to banks in Northern Europe to escape seizure,” he said.

Full article HERE

France plans currency swap line with China

Looks likes the BRICS team just got bigger. Reuters reports HERE

France intends to set up a currency swap line with China to make Paris a major offshore yuan trading hub in Europe, competing against London, the China Daily on Saturday cited Bank of France Governor Christian Noyer as saying.

“The Bank of France has been working on ways to develop a RMB liquidity safety net in the euro area with due consideration of a supporting currency swap agreement with the People’s Bank of China,” Noyer told the English-language newspaper.

The yuan’s internationalization and bilateral financial cooperation could be among the main topics during French President Francois Hollande’s visit to China in late April, the paper said.

French Foreign Minister Laurent Fabius paid a two-day visit to Beijing this week.

The planned swap line would be the latest in a string of bilateral currency agreements that China has signed in the past three years to promote use of the yuan in trade and investment.

It followed a similar step by the Bank of England to set up a reciprocal three-year yuan-sterling swap line with China.

Britain, always anxious to maintain London’s status as Europe’s biggest financial center, launched an offshore yuan currency and bond market to great fanfare last year.

Federal Workers Exempt from Key Insider Trading Requirement

Well in the words of Gomer Pyle, Suprise Suprise Suprise. Looks like congress doesn’t think transparency is as good for them as it is the rest of us. Lets see what the vipers are trying to slither out of today….

Back in 2012, amid “intense pressure from Obama” including an appeal for its passage in his 2012 State of the Union address, Congress passed the Stop Trading on Congressional Knowledge (STOCK) Act (with 96-3 theatrical votes in the Senate, and 417-2 even more theatrical votes in the House) – a bill prohibiting the use of non-public information for private profit, including insider trading by members of Congress and other government employees. It is unclear why until 2012 it was perfectly legal for congress to trade on inside information, something we pointed out in May 2011 when we wrote that a “A Hedge Fund Comprised Of Junior Congressional Democrats Should Outperform The Market By 9%” as it turned out flagrant insider trading abuse occurred mostly within the democrat ranks of the House (compared to a mere 2%+ outperformance by Congressional stock trading republicans).

It turns out that any cynical skepticism regarding Congress’ ability and willingness to police itself was well founded, as last night the House eliminated a “key requirement of the insider trading law for most federal employees, passing legislation exempting these workers, including congressional staff, from a rule scheduled to take effect next week that mandated online posting of financial transactions.”

The reason why one will have to take Congress at its word that it is not breaking the law? Because apparently posting Congress’ financial dealings online would be pose a “national risk” according to the National Academy of Public Administration.

Surely this explains why the bill was rushed and voted in the matter of hours: one can’t have a debate over matters of “national security” especially if the financial well-being of Congress is at risk. As Washington Times recaps, “Senate Majority Leader Harry Reid, Nevada Democrat, introduced the bill on Thursday and had the chamber vote on it late that evening. The House took the bill up on Friday afternoon and passed it by unanimous consent, with no members objecting. Republican leaders did not give lawmakers the traditional three days to read the bill before holding a vote. One GOP aide told The Washington Times the three-day rule did not apply to Friday’s action because the bill came from the Senate, while another said the House moved quickly because of a Monday deadline for the new disclosure mandates to take effect.”

In other words, while the STOCK Act passed nearly unanimously in 2012 just to show how “honest” congress is, the follow up legislation that effectively undoes the key reporting requirement of said anti-inside trading law passed just as unanimously, allowing congress to have its shady dealings cake, and eat its non-inside trading reputation too.

That both democrats and republicans rushed to pass this provision shows just how truly engrained the unwillingness for true transparency in Congress is.

Obviously, the justification spin for eliminating the key STOCK act provision was ready and just waiting to be unleashed:

House Majority Leader Eric Cantor’s spokesman Rory Cooper told CNN the decision to enact new legislation now was in direct response to the study.

“In December when we extended the STOCK Act deadline for public disclosure of Financial Disclosures, we required a study by the non-partisan and independent National Academy of Public Administration. This was their recommendation, and the House and Senate agreed it was the best course of action for the time being,” Cooper told CNN in a written statement.

In other words, according to the “nonpartisan and independent” NAPA, having Congressional financial documents online represents a national security risk. Because somehow terrorists will terrorize the US even more when they know on what days Nancy Pelosi bought and sold the S&P 500.

Federal employees began expressing concerns about the national security risks of posting personal financial information online soon after government agencies moved to implement the STOCK Act last year.

Online posting was supposed to begin August 31, 2012, but Congress passed extensions three separate times pushing off the compliance date.

In December, the last time the House and Senate approved another extension signed by the president, they also directed the National Academy of Public Administration (NAPA), a non-profit group of public management experts chartered by Congress, to study whether there were real security risks associated with putting this kind of financial information on the Internet.

…

Part of the law required that senior government officials’ financial disclosure reports — which they are already required to submit in paper — be made available online in a searchable, sortable format. The belief was that publishing them online would make it easier for reporters and the public to try to spot illicit dealings.

The online disclosure provisions had not yet taken effect, and Congress asked NAPA to review the law.

In a report release last month a five-member NAPA panel said online posting would mean more sensitive information about high-level government employees would be easily available, which would make identify theft easier.

“An open, online, searchable and exploitable database of personal financial information about senior federal employees will provide easy access to ‘high quality’ personal information on ‘high value’ targets,” NAPA officials said in their report.

The Defense Department told NAPA that online disclosure would mean hostile nations would have easy access to sensitive personal information about top national security officials.

Because “hostile nations” have nothing better to do than trade alongside Congressmen with the usual 13F, 45-day delay. In the meantime, those who truly would benefit from this transparency: the media, or least those very few in the media who have not been bought by Congress just yet, and are willing to check which members of Congress are now actively breaking the STOCK law, will have their work cut out for them.

At least someone spoke up, although their objection will be promptly ignored and forgotten.

One advocacy group pushing for greater government transparency blasted the move, saying it “guts” the law.

“Not only does the change undermine the intent of the original bill to ensure government insiders are not profiting from non-public information, it sets an extraordinarily dangerous precedent suggesting that any risks stem not from information being public but from public information being online,” Lisa Rosenberg of the Sunlight Foundation wrote in a statement.

Yet, fundamentally all last night’s accelerate revision to the STOCK act does is pray on the laziness of “terrorist” and, of course, reporters:

With this change those federal workers would still have to report any securities trades over the law’s $1,000 threshold within 45 days. While these reports would be publicly available, they would no longer be posted online in a format that anyone can search or download.

So basically “hostile nations” can still access all the data, however it will be in paper format. And this avoids national security risks just how?

Of course, if indeed this is merely a bet on the laziness of the financial media, it is probably safe one. After all it appears that said financial media would rather spend hours discussing and lamenting the sad future of the financial media, especially how slideshows of kittens are part of the great profitability strategy…

Full Hedge Article HERE

“Discontent is the first step in the progress of a man or nation” ~ Today’s fortune cookie from lunch

US Warns Japan Not to Print Too Much Money

Thought everyone could use a laugh first thing Saturday morning…..

The U.S. Treasury on Friday warned Japan not to actively weaken its currency as it again refrained from naming China a manipulator.

“We will continue to press Japan to adhere to the commitments agreed to in the G-7 and G-20, to remain oriented towards meeting respective domestic objectives using domestic instruments and to refrain from competitive devaluation and targeting its exchange rate for competitive purposes,” the Treasury said.

Full humor can be read HERE

Creating Jobs Reminder

Just a small reminder to folks how jobs are actually created. My parents own a grocery store and the jobs they supply constitute stocking shelves, greetings customers, carrying items, and cleaning up isles. This is not a carrier path meant to sustain a large family or pay for retirement. These are base jobs requiring base skill-sets. It is however a good job for learning job skills (especially when younger), or some additional part time work if extra cash is needed or desired.

Owning your own store and business takes a lot of work. This usually means 40-60 work weeks (especially when starting). Now in their later years, they have reduced their hours to 30-35 and enjoy a few more weekends (as they should after decades dedicated to their business). In order to do that they needed to hire more help at the store and extend hours to their employees. The new employes and extended hours were welcomed by those employed. In addition, they had a little extra and allowed a special needs kid twice a week to learn job skills cleaning and fronting shelves. Besides, everyone loved having him around. Then, along came a spider. A sharp rise in minimum wage. The intent of course here is to raise the overall take home of those on the lower scale of the labor force. The REALITY however is much different. What actually happens is that my parents can no longer afford the additional labor they hired. The margins off the cans of soup are no longer enough to sustain the extra labor cost. As a result, my parents once again start working 40 – 50 hours a week, fired one of the newer employes, and let go the special needs kid who was receiving the benefit of excess capital. Sure, the remaining employees received a higher take home pay. But, even then overtime was strictly monitored.

Hedge payed a reminder to these realities….

The Creation of Jobs

If the media tell us that “the opening of XYZ mill has created 1,000 new jobs,” we give a cheer. When the ABC company closes and 500 jobs are lost, we’re sad. The politician who can provide a subsidy to save ABC is almost assured of widespread public support for his work in preserving jobs.

But jobs in and of themselves do not guarantee well-being. Suppose that the employment is to dig huge holes and fill them up again? What if the workers manufacture goods and services that no one wants to purchase? In the Soviet Union, which boasts of giving every worker a job, many jobs are just this unproductive. Production is everything, and jobs are nothing but a means toward that end.

Imagine the Swiss Family Robinson marooned on a deserted South Sea island. Do they need jobs? No, they need food, clothing, shelter, and protection from wild animals. Every job created is a deduction from the limited, precious labor available. Work must be rationed, not created, so that the market can create the most product possible out of the limited supply of labor, capital goods, and natural resources.

The same is true for our society. The supply of labor is limited. We must not allow government to create jobs or we lose the goods and services which otherwise would have come into being. We must reserve precious labor for the important tasks still left undone.

Alternatively, imagine a world where radios, pizzas, jogging shoes, and everything else we might want continuously rained down like manna from heaven. Would we want jobs in such a utopia? No, we could devote ourselves to other tasks—studying, basking in the sun, etc.—that we would undertake for their intrinsic pleasure.

Instead of praising jobs for their own sake, we should ask why employment is so important. The answer is, because we exist amidst economic scarcity and must work to live and prosper. That’s why we should be of good cheer only when we learn that this employment will produce things people actually value, i.e., are willing to buy with their own hard-earned money. And this is something that can only be done in the free market, not by bureaucrats and politicians.

The Destruction of Jobs

But what about unemployment? What if people want to work, but can’t get a job? In almost every case, government programs are the cause of joblessness.

Minimum Wage. The minimum wage mandates that wages be set at a government-determined level. To explain why this is harmful, we can use an analogy from biology: there are certain animals that are weak compared to others. For example, the porcupine is defenseless except for its quills, the deer vulnerable except for its speed.

In economics there are also people who are relatively weak. The disabled, the young, minorities, the untrained—all are weak economic actors. But like the weak animals in biology, they have a compensating advantage: the ability to work for lower wages. When the government takes this ability away from them by forcing up pay scales, it is as if the porcupine were shorn of its quills. The result is unemployment, which creates desperate loneliness, isolation, and dependency.

Consider a young, uneducated, unskilled person, whose productivity is $2.50 an hour in the marketplace. What if the legislature passes a law requiring that he be paid $5 per hour? The employer hiring him would lose $2.50 an hour.

Consider a man and a woman each with a productivity of $10 per hour, and suppose, because of discrimination or whatever, that the man is paid $ 10 per hour and the woman is paid $8 per hour. It is as if the woman had a little sign on her forehead saying, “Hire me and earn an extra $2 an hour.” This makes her a desirable employee even for a sexist boss. But when an equal-pay law stipulates that she must be paid the same as the man, the employer can indulge his discriminatory tendencies and not hire her at all, at no cost to himself.

Comparable Worth. What if government gets the bright idea that nurses and truck drivers ought to be paid the same wage because their occupations are of “intrinsically” equal value? It orders that nurses’ wages be raised to the same level, which creates unemployment for women.

Working Conditions. Laws which force employers to provide certain types of working conditions also create unemployment. For example, migrant fruit and vegetables pickers must have hot and cold running water and modern toilets in the temporary cabins provided for them. This is economically equivalent to wage laws because, from the point of view of the employer, working conditions are almost indistinguishable from money wages. And if the government forces him to pay more, he will have to hire fewer people.

Unions. When the government forces businesses to hire only union workers, it discriminates against non-union workers, causing them to be at a severe disadvantage or permanently unemployed. Unions exist primarily to keep out competition. They are a state-protected cartel like any other.

Employment Protection. Employment protection laws, which mandate that no one can be fired without due process, are supposed to protect employees. However, if the government tells the employer that he must keep the employee no matter what, he will tend not to hire him in the first place. This law, which appears to help workers, instead keeps them from employment. And so do employment taxes and payroll taxes, which increase costs to businesses and discourage them from hiring more workers.

Payroll Taxes. Payroll taxes like Social Security impose heavy monetary and administrative costs on businesses, drastically increasing the marginal cost of hiring new employees.

Unemployment Insurance. Government unemployment insurance and welfare cause unemployment by subsidizing idleness. When a certain behavior is subsidized—in this case not working—we get more of it.

Licensing. Regulations and licensing also cause unemployment. Most people know that doctors and lawyers must have licenses. But few know that ferret breeders, falconers, and strawberry growers must also have them. In fact, government regulates over 1,000 occupations in all 50 states. A woman in Florida who ran a soup kitchen for the poor out of her home was recently shut down as an unlicensed restaurant, and many poor people now go hungry as a result.

When the government passes a law saying certain jobs cannot be undertaken without a license, it erects a legal barrier to entry. Why should it be illegal for anyone to try their hand at haircutting? The market will supply all the information consumers need.

When the government bestows legal status on a profession and passes a law against competitors, it creates unemployment. For example, who lobbies for the laws which prevent just anyone from giving a haircut? The haircutting industry—not to protect the consumer from bad haircuts, but to protect themselves against competition.

Peddling. Laws against street peddlers prevent people from selling food and products to people who want them. In cities like New York and Washington, D.C., the most vociferous supporters of anti-peddling laws are established restaurants and department stores.

Child Labor. There are many jobs that require little training—such as mowing lawns—which are perfect for young people who want to earn some money. In addition to the earnings, working also teaches young people what a job is, how to handle money, and how to save and maybe even invest. But in most places, the government discriminates against teenagers and prevents them from participating in the free enterprise system. Kids can’t even have a street-corner lemonade stand.

The Federal Reserve. By bringing about the business cycle, Federal Reserve money creation causes unemployment. Inflation not only raises prices, it also misallocates labor. During the boom phase of the trade cycle, businesses hire new workers, many of whom are pulled from other lines of work by the higher wages. The Fed subsidy to these capital industries lasts only until the bust. Workers are then laid off and displaced.

The Free Market. The free market, of course, does not mean utopia. We live in a world of differing intelligence and skills, of changing market preferences, and of imperfect information, which can lead to temporary, market-generated unemployment, which Mises called “catallactic.” And some people choose unemployment by holding out for a higher paying job.

But as a society, we can insure that everyone who wants to work has a chance to do so by repealing minimum wage law, comparable worth rules, working condition laws, compulsory union membership, employment protection, employment taxes, payroll taxes, government unemployment insurance, welfare, regulations, licensing, anti-peddling laws, child-labor laws, and government money creation. The path to jobs that matter is the free market.

Live Free or Die - A.K.A Yes, They're Really THAT Stupid

There is a very good reason we keep an eye on good Emperor Misha’s subjects – and this next post is one of them.

LC Light29ID at the Anti-Idiotarian Rottweiler asks his readers if the traitors in the Senate preparing to auction American liberty are “really” so stupid as they appear. One of the Rotties replies:

Are they truly that stupid?

No.

They are that Goddamned EVIL and corrupt. These are the actions of wicked tyrants, who are out to enslave us and our decedents. This legislation is the final line – they cannot help themselves this close to total victory. If they get their list, then the war for liberty is lost.

Know this – tis the end-game – we’re playing for the entire enchilada this quarter. Your “representatives” have just declared Goddamned constitutional convention on their own. Do you understand the magnitude of this? These gentry-class shit-weasels are destroying the Bill of Rights in front of you, while defiantly snarling, “What are you going to do about it, you stupid troglodyte knuckle-dragging rednecks?”

This has been pre-meditated, and carefully scripted. There will be sell-outs, cave-ins, horse-trading, and all of the “great-conservative” talking heads will console people to “remain calm.” “Don’t get all uppity folks,” they will blast from their Ionic pillars – “the House of Representatives” will make it all better.”

They won’t though.

“Now don’t get in a tizzy… the Supreme court will kiss your boo-boo and make the hurt go bye-bye!”

They will refuse.

“Just simmer down till the mid-term elections!” “Or the next presidential election!”

It won’t help. The feckless Rebublocrats will find every excuse to fail, shrug their shoulders, and say “Well shucks, we did all we could… hey at least we are better than those Demoicans!”

Of course, just like with Obamacare…. the fix is IN folks. The outcome for this was determined before the fight ever started. It’s a casino – not a government. Your freedom is right this instant being swapped, for Pork projects, pet legislation, campaign cash, and oversight committee positions.

Why the fuck should they care if you and your kids are being sold into slavery – they have armed guards for them and theirs. Know you mother-fucking place serfs.

The response to this final infringement must be severe, violent, and hugely disproportionate. Why? Simple – because with this final act of rebellion against our founders, they now plant the seeds of complete tyranny – the sorts we saw rise at the beginning of the last century. They now march us towards oblivion – a darkness that will cover the entire earth.

The foundation of our nation has decayed like a rotten tooth. There no longer exists a peaceful means within our system to un-fuck that which has been forever and wholly fucked. Those with a conservative or libertarian mindset have no representation in this illegitimate system, and the democratic tyranny infesting it will never allow us to have one. Ever. This is by no means unintentional.

The only way we will have a voice is if we take it. And tyrants do not relinquish freedom lightly.

They deliberately stifle, marginalize, an destroy our world-view and representation – and make no mistake – they will get around to killing and destroying us one by one. Just as their precursors in Russia, China, Germany, Korea, Vietnam, and elsewhere, these monsters mean to make beggars, corpses, and slaves of you and your ancestors.

Their intentions are crystal clear – they mean the destruction of our very way of life. Of our culture. And if their Utopia’s capital city has to be a throne of bones atop a mountain of skulls, they will cheer it’s construction every step of the way.

Gentlemen and ladies, it’s time to acknowledge that open warfare with our government is unavoidable if we are not to become prisoners, slaves and corpses. We need to accept, and prepare for reality. We are going to have to go to war, and do all of the horrible things that will be required of soldiers in war.

So choose your place now. Registration is the end. They will have their list, and they will run us down one at a time, and always there will be some other crime to keep us from being sympathetic. Tax evaders! Drug users! Had a “cache” of restricted ammo! Hoarders!

You want to know what Germany looked like in 1930? LOOK OUT THE WINDOW.

If we go to war once this last intolerable tyrannical infringement occurs, it’s on them. If we stand by silently and allow them to build their awful Reich, what comes after is on US, the good men and women who sat by idle and did nothing in the face of true evil. We have no excuses. WE KNOW WHAT’S GOING TO HAPPEN. We KNOW where this leads.

If we sit back, and languish in our chains, it’s OUR fault, for we did nothing to stop them when we could act.

Live free or fucking die.

– HempRopeAndStreetlight

Read the entire post HERE.

That’s some wickedly depressing shit – and a horribly accurate assessment of how far up Fuck-Street America is. Pretty damn salient, (if frightening), points being made. After all, the damnable Senators basically have called their own private constitutional convention, (unlawfully), for the express purpose of infringing on “that which shall not be infringed.”

It’s also maddeningly clear that, just as with the Abortion that is the “Affordable Care Act,” there will be enough arms twisted and palms greased to “make it all legal.” We at times wonder if our royal-caste knows how thin the veneer really is on this whole “civil society” thing. Lots of nasty splinters lurking under that shiny finish hunting for pokey fingers…

The Rotties are spot on again… damn it all. We the freedom loving people don’t have one lick of representation anymore – we’re voiceless – our government represents itself. We are sold into servitude and back-stabbed by our “own” at every opportunity. Which really means we DON’T have our “OWN.” We toil under those who hate us, and those who hate us MORE.

From our perspective “The Gods of the Copybook Headings” is rapidly becoming the literary equivalent of an ear-worm advertising jingle….

When the Cambrian measures were forming, They promised perpetual peace.

They swore, if we gave them our weapons, that the wars of the tribes would cease.

But when we disarmed They sold us and delivered us bound to our foe,

And the Gods of the Copybook Headings said: “Stick to the Devil you know.”

– Rudyard Kipling

Damn-it.

We blame Bill Quick. He’s the one responsible for introducing us to this “mind-worm.” Reward him for his prescience by throwing some coins in his tip-jar – so the good man can afford to escape his communist Shit-pit state.

Cyprus to Sell Their Gold as Condition of Bailout

Heh. That didn’t take long. Hard assets are meaningless. Unless of course you have a chance to confiscate them…

Reuters reports HERE

Cyprus has agreed to sell excess gold reserves to raise around 400 million euros (341 million pounds) and help finance its part of its bailout, an assessment of Cypriot financing needs prepared by the European Commission showed.

Update:

The Central Bank of Cyprus (CBC) said last night however that selling the island’s gold had not been on the table.

“Such an issue has not been raised, has not been discussed and is not being discussed at the moment,” CBC spokeswoman Aliki Stylianou said.

Stylianou added that sale of the gold was a matter handled exclusively by the CBC board.

A spokesperson for the Central Bank of Cyprus told the Cyprus News Agency (CNA) that reports of the $523 million gold sale have not been, “raised, discussed or debated,” with the bank’s board of directors.

Nothing to see here.

I Hope I'm Clear With You, and You Understand My Point of View...

Presented without comment….

You were very clear Sir. Very clear…..

The Fact is, They WILL Shoot You When Ordered

Our soldiers and police are being trained and indoctrinated to do exactly that. Pamela Geller at Atlas Shrugs has a preview of what our soldiers are being trained on:

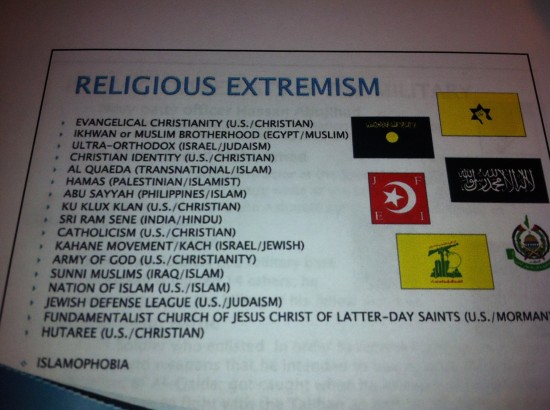

The U.S. Army listed Evangelical Christianity and Catholicism as examples of religious extremism along with Al Qaeda and Hamas during a briefing with an Army Reserve unit based in Pennsylvania.

“We find this offensive to have Evangelical Christians and the Catholic Church to be listed among known terrorist groups,” said Ron Crews, executive director of the Chaplain Alliance for Religious Liberty. “It is dishonorable for any U.S. military entity to allow this type of wrongheaded characterization.”

The incident occurred during an Army Reserve Equal Opportunity training brief on extremism. Topping the list is Evangelical Christianity. Other organizations listed included Catholicism, Al Qaeda, Hamas, the Ku Klux Klan, Sunni Muslims, and Nation of Islam.

The military also listed “Islamophobia” as a form of religious extremism.

– Pamela Geller

Read the entire thing HERE.

The Soldiers and police won’t be told “OK boys, we’re going to disarm the law-abiding citizens in an unconstitutional manner today – go get them!”

They will sent to kill “insurrectionists,” “terrorists” and arrest “criminals endangering civilians.” Here is how it will go down, courtesy of David Hathaway. Read and understand.

What really happens is that good ol’ patriotic cops are told by their bosses to show up at the police department at o dark thirty for a briefing about the execution of a search warrant. This happens hundreds of times every day. These law enforcement agencies often have military personnel and resources dedicated to assist in their mission as well. No one ever objects. There is action afoot against n’er do wells. It is based on a hush-hush deep dark sinister undercover deal. It can’t be discussed because cooperators are “in deep” and it’s all “need to know.”

Fortunately, your buddy gets to be in on the action the day that the door kicking is done. It will be cool. It’s like black ops. It’s like a video game. It’s like a military adventure against the ferreted-out scum of society. It’s exciting and he gets to be there. He can meet his cop pals at Pizza Hut later on for lunch and brag about how he punched a guy who “had an attitude” and made him throw up and said, “How’d you like that home boy? Get used to that. You are going to get a lot more of that in the joint, if you’re lucky!” Before the raid, he is already getting a few comic one liners ready to go with the catchy punch lines to be thrown in later describing something like how a perp soiled himself when your cop buddy demonstrated his manhood by pointing an M4 at his forehead. These guys are scum and he has to get his licks in and deal firmly with them before those pansies in the courts get ahold of them and dismiss everything on some technicality.

On the day of the raid, there are lots of cops milling around until the master of ceremonies begins the sermon. The M.C. is someone who is praiseworthy due to rank; somebody like the Chief of Police. A general tirade slowly builds from the orator about what various scum infiltrators have done to our communities. Veiled references to politics are made. It is mentioned how “the current administration, I won’t name names” is mollycoddling the crooks and not keeping our children safe. Then a hush of silence comes over the room as the M.C. introduces the plain clothes detective, investigator, or case agent.

The detective, in a dramatic almost whispering voice, says that no details can be given to the mass of assembled cops. People are in deep. There are sensitive infiltrators inserted in the group that need their identities protected, “So we can’t talk in detail but, just let it be known that these people we are going after today are the worst. They walk amongst our families at the mall. They go to school with your kids. They are a thorn in our side.” He looks over at the Chief of Police and begins a reciprocated round of suggestive head nodding, like yeah boy, I hear that. The uniformed crowd stays silent in awe of the plain clothes guy who has risen in the ranks to the point where he can sleuth together paper cases, even when no crimes are apparent, and bust down doors with another piece of paper. The detective says, “Seize computers, papers, and containers. Take cell phones and address books. Take reading material like gun magazines so we can show the judge where these people’s heads are at. Separate the subjects and get down incriminating statements. If there are any minors present, we have social services on standby to take the kids.” – David Hathaway

Read the rest HERE.

We are the enemy folks. They will kill us, lock us in cages, and sleep soundly the next day, confident they fought the good battle for peace, justice, and the American way.

Australia superannuation funds over $100,000 to be taxed 15%

It looks as if the EU area isnt the only ones eying investment and savings funds over 100k….

Though Australia’s national balance sheet is comparatively quite strong, the government has been running at a net deficit for years… and they’re under intense pressure to balance the budget.

The good news is that Australia now has a goodly number of investor-friendly immigration programs designed to bring productive foreigners into the country, similar to the trend we’re seeing across Europe.

On the flip side, though, the Australian government has just announced new rules which penalize citizens who have responsibly set aside savings for their own retirement.

Any income over A$100,000 drawn from a superannuation fund (the equivalent of an IRA in the United States) will now be taxed at 15%. Previously, all such income was tax-free.

The really offensive part about this is that the government is going to tax people’s savings ‘on both ends,’ meaning that people are taxed on money they move INTO the retirement fund, and now they can be taxed again when they pull money out.

The Cyprus debacle drew a line in the sand– fleecing people with assets, or income, in excess of 100,000 dollars, euros, etc. is now acceptable. This is the definition of ‘rich’ in the sole discretion of governments.

And make no mistake– if it can happen in Australia, which still has reasonable debt levels despite years of deficit spending, it can happen in bankrupt, insolvent nations like the US.

As you may know, US tax code allows for several different types of retirement accounts… and there has been a lot of talk lately about a ‘Roth conversion’.

This is to say that a US taxpayer can convert his/her traditional IRA to a Roth IRA. And the implications are enormous.

A traditional IRA is not taxed on the way in, but it’s taxed on the way out. So if you contribute $3,000 annually to your IRA, you won’t pay income tax on that $3,000. But the accumulated retirement savings is taxed in the future when you withdraw the funds at retirement.

Conversely, contributions to a Roth IRA are taxed each year with the rest of your income. But the accumulated savings are NOT taxed when you withdraw the funds at retirement.

A few years ago, Congress inked a deal to allow US taxpayers to CONVERT their traditional IRA to a Roth IRA. In doing so, Americans were allowed to pay tax on the accumulated gains in their traditional IRA up through that point, then switch to a Roth.

Congress was essentially saying, “We promise that we will only tax you now in exchange for not taxing you later.”

It certainly begs the question: How much do you trust your government?